Know Your Coverage: Exploring the General Aggregate Limit in Insurance Policies

Knowing the specifics of your insurance coverage is crucial in the world of insurance. Understanding the extent and constraints of your coverage is just as important as the premiums you pay. The General Aggregate limit is an important component of insurance plans. This is the most that an insurer will pay for insured losses throughout the course of a policy, and it is essential to protecting your financial interests. We’ll go into the General Aggregate limit, its importance, and how it affects your insurance coverage in this blog post.

Unraveling the General Aggregate Limit:

A key component of many insurance plans, particularly liability insurance, is the General Aggregate limit. It specifies the maximum amount of money that an insurance provider will pay for all insured losses throughout the course of a particular policy cycle. This cap includes the entire cumulative amount of claims made over the insurance period rather than being linked to a specific claim.

Why the General Aggregate Limit Matters:

1. Comprehensive Protection: The General Aggregate limit guarantees a thorough degree of protection against losses that are insured. It displays the insurer’s dedication to paying for a wide range of potential claims during the policy term.

2. Financial Safeguard: This cap acts as a safety net for money. It establishes a defined limit for your insurance coverage, avoiding unforeseen costs in the event of several claims.

3. Predictability: It is easier to anticipate how much your insurer will pay for claims when you are aware of the General Aggregate limit. It helps you make appropriate plans by giving you insight on the extent of your coverage.

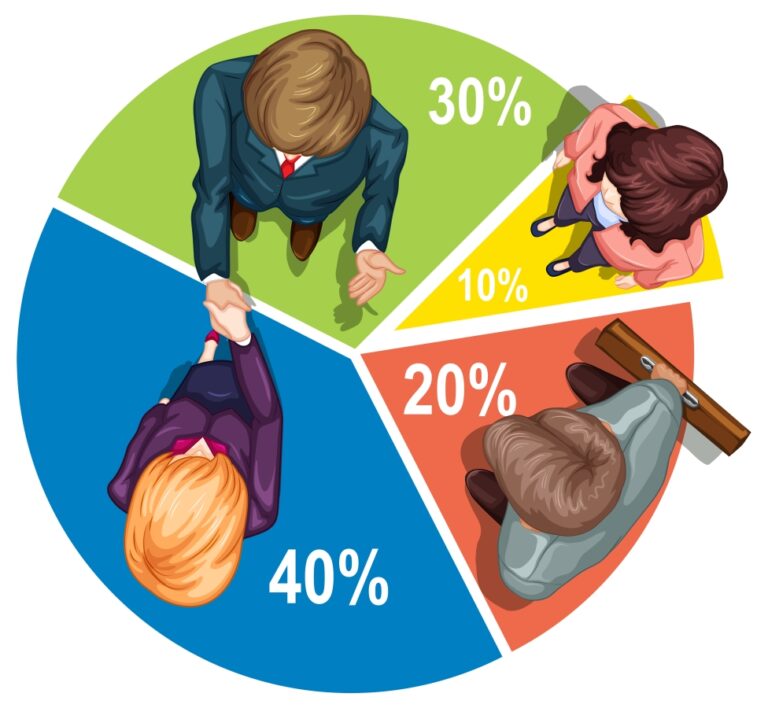

4. Resource Allocation: When people and businesses are aware of their insurance coverage, they may make informed resource allocations. Having a general aggregate limit helps in decision-making.

Exhausting the General Aggregate Limit:

It is important to understand that the insurer will stop paying claims if the General Aggregate limit is reached during the policy period. As a result, your coverage can end before the policy’s term ends. It’s critical to keep an eye on your claims and adjust your coverage budget appropriately.

Customizing Your Coverage:

There is no one-size-fits-all insurance policy. Frequently, you may modify your coverage to meet your unique requirements. Among other things, this might entail changing the General Aggregate limit in the policy. Make sure you collaborate with your insurance company to design a coverage that meets your specific needs.

Conclusion: Your Financial Safety Net

In the world of insurance, your financial safety net is the General Aggregate limit. It guarantees protection against a variety of covered losses and establishes a distinct limit for your coverage. To properly manage your risk and make well-informed decisions, you must be aware of this limit. Ensuring the security of your finances and maintaining your peace of mind is a crucial aspect in the realm of insurance.