Davis-Bacon prevailing wage

The Davis-Bacon prevailing wage is a federal law in the United States that requires contractors and subcontractors to pay their workers a certain minimum wage rate for public works projects.

The wage rate is based on the prevailing wage in the locality where the construction work is taking place.

Determine your minimum wage rate

The Wage Determinations Online (WDOL) is a U.S. government website managed by the Department of Labor that provides information on prevailing wage rates for federal contract work. These wage determinations are based on surveys conducted by the Department of Labor and provide minimum wage rates for various types of jobs and labor categories in specific geographic locations.

What is a wage determination

A wage determination (WD) is a set of wages, fringe benefits, and work rules that the U.S. Department of Labor has ruled to be prevailing for a given labor category in a given locality.

Weekly reporting on davis bacon projects

Form WH-347 is a payroll form required by the U.S. Department of Labor for contractors and subcontractors working on federally funded or assisted contracts. Each week you must report the wages and fringe benefits paid to employees who have worked on a specific federal contract or project.

Top of Form WH-347

Enter your Company information: This includes your company name, address, and federal employer identification number (FEIN).

Davis-Bacon Certified Payroll Guidance

Form WH-347 (or other) Completion Instructions. Note: A bona fide subcontractor must have a signed agreement with the Contractor containing Federal Labor Standards, and a copy of the Wage Decision issued for the project.

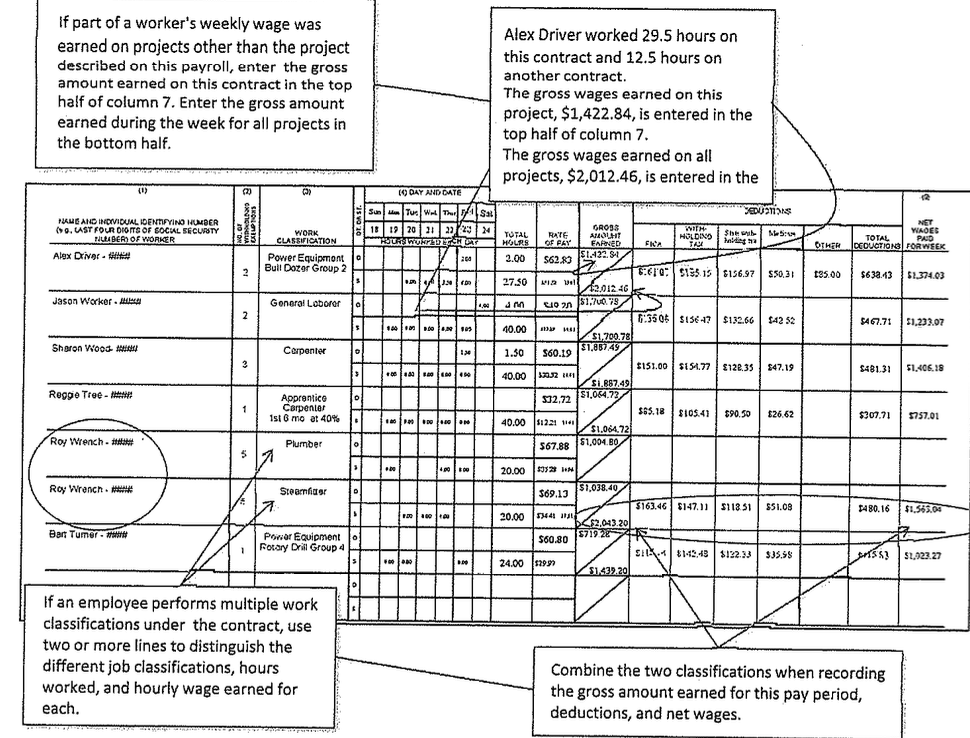

Column 1- Enter who worked on site

Employee information: This includes the name, social security number, and job classification of each employee who worked on the contract during the payroll period. The wages reported in Column 1 should reflect the total wages paid to each employee during the payroll period, regardless of their withholding exemptions.

Column 2- Withholding exemptions

Withholding exemptions are the number of allowances an employee claims on their W-4 form, which determines how much federal income tax is withheld from their paycheck. To complete Column 2, you will need to ask each employee to provide you with their withholding exemptions. You should enter the number of exemptions claimed by each employee in the appropriate box in Column 2.

Column 3- Work classification

The codes are typically four-digit numbers that correspond to specific work categories. Work classification refers to the type of work that was performed by the employee, such as carpenter, electrician, plumber, or laborer. Find here (WDOL) website at https://beta.sam.gov/wage-determinations/

Column 4- Day and date

Hours worked: You will need to report the total number of hours worked by each employee during the payroll period, as well as the rate of pay for each employee.

Column 5 - Total hours

Add up each person hours from the whole week. Each employee can have a different total of hours worked.

Column 6- Rate of pay

This minimum amount is determined by Department of Labor. You can report that you paid your employees more than the minimum. https://sam.gov/content/wage-determinations

Column 7- Gross Amount Earned

Multiply the total hours worked per week by the rate of pay for each employee.

Column 8- Deductions

Fringe benefits: If you provided any fringe benefits to your employees, such as health insurance or retirement plans, you will need to report the amount of those benefits.

Column 9- Net Wages Paid for Week

Add column 7 - The gross amount earned plus the Total deductions from column 8.

FICA Calculation: Multiply the gross amount earned by 7.65%.

With-Holding Tax Calculation: Multiply the gross amount earned by 4.5%.

Method to use to fill in Form WH-347

You can type on this form with a pdf editor or you need to print and hand write the information.

After Form WH-347 is all filled in

Submit it to the contracting officer or authorized representative for the federal agency overseeing the project. It is important to ensure that the form is completed accurately and submitted on time to avoid any penalties or fines.

Advangtes: Reduced competition

Since wage rates are higher usual, some contractors can not afford the payroll cost, which can reduce competition and increase the chances of winning the contract.

Advantages: Higher quality workforce

Paying higher wages can attract a higher quality workforce with more experience and skills, which can result in better productivity, higher quality work, and fewer mistakes.

Is there more profit?

Ultimately, the profitability of Davis-Bacon prevailing wage projects depends on your company's ability to manage costs, complete the project on time and within budget, and deliver high-quality work.

Where are Davis-Bacon prevailing wage projects

Projects can be found in both big cities and small towns, as they apply to federal construction projects throughout the United States. Some projects may involve the construction of government buildings, bridges, or highways, while others may involve the renovation or repair of existing facilities.

Contact support

24×7 help from our support staff

Popular Topics